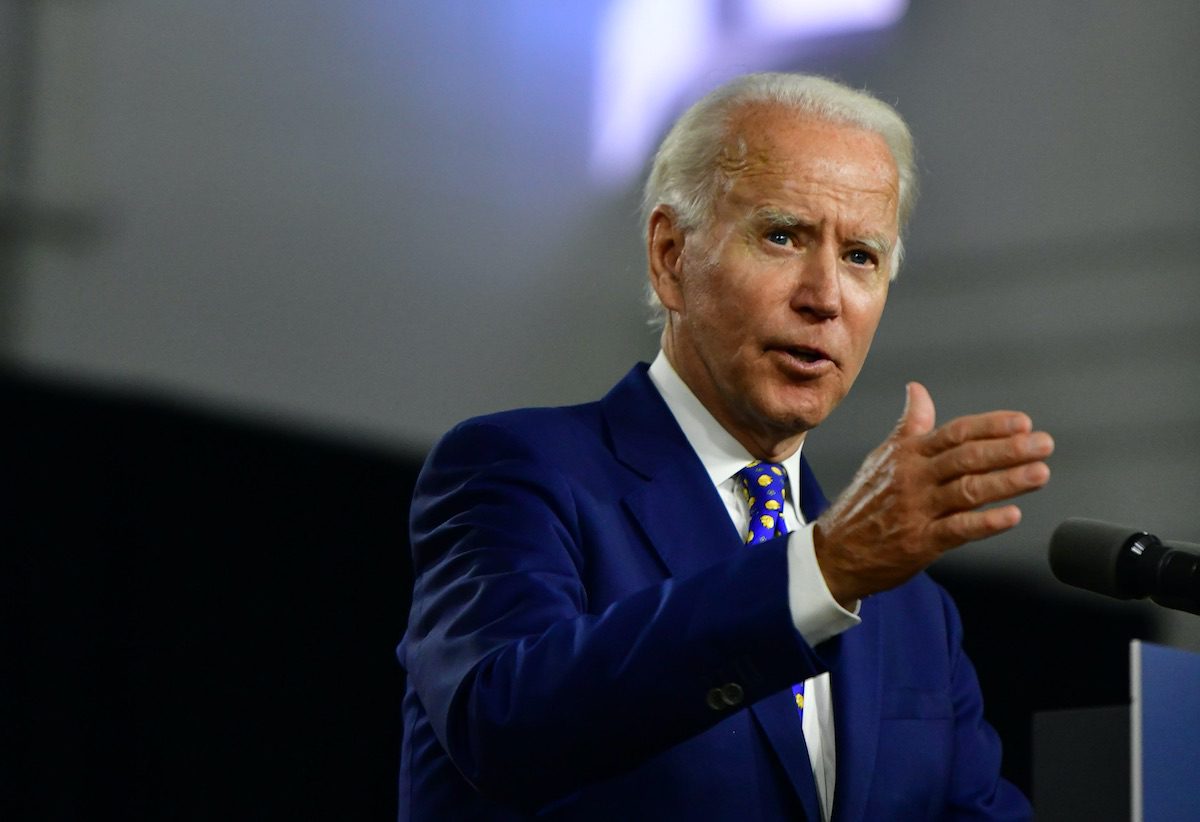

(Photo: Mark Makela/Getty Images)

(Photo: Mark Makela/Getty Images)

An additional 230,000 student loan borrowers could see relief after the Biden administration announced plans to cancel more than $1.3 billion in student loan debt.

Those who qualify for loan forgiveness have, in many cases, loan balances that were previously wiped out by the government, but came back because borrowers had failed to keep officials updated about their incomes.

Borrowers eligible for the new student loan forgiveness should be totally and permanently disabled, according to the Department of Education. They are required to submit earnings documentation for three years as a condition of their loan discharges, to demonstrate that they continued to need the relief.

Loans were reinstated if the borrowers failed to show that their incomes remained below government thresholds.

The Biden administration said it’s another step to make sure student loan debtors “receive support and protection during the COVID-19 emergency.” Due to the COVID-19 pandemic, Biden has also paused student loan payments and interest through Sept. 30.

“Borrowers with total and permanent disabilities should focus on their well-being, not put their health on the line to submit earnings information during the COVID-19 emergency,” said Education Secretary Miguel Cardona, in a news release issued this week.